Providing financial advisors & wealth managers with an AI Sidekick-Arta

Arta, a software as a service platform designed to give financial institutions and consumers access to AI agents for wealth management,announced the continued development of Arta AI [November 6, 2025].

Arta is an AI-driven wealth and financial technology company headquartered in the United States and Singapore. Through its regulated Arta Wealth business and enterprise SaaS platform, Arta AI, the company blends powerful artificial intelligence with human financial expertise and world-class experience design to allow wiser investment decisions, scalable personalisation, and measurable business outcomes.

The company already has prominent finance & technology leaders backing it including Ralph Hamers (former CEO of UBS & ING), Piyush Gupta (former CEO of DBS), Eric Schmidt (former CEO of Google), Michael Miebach (CEO of Mastercard), and Lip Bu Tan (CEO of Intel).

With Bank of Singapore, Hong Leong Bank, and Ethivo Asset Management (HK) Ltd, formerly known as UCAP HK AM Ltd, joining current clients Wio Invest operated by Wio Securities LLC and Income Advisory Financial Advisers, a wholly-owned subsidiary of Income Insurance Limited, the AI Sidekick is now being implemented across a growing network of banks and wealth management firms. It is now accessible to all investors, wealth managers, and advisors worldwide.

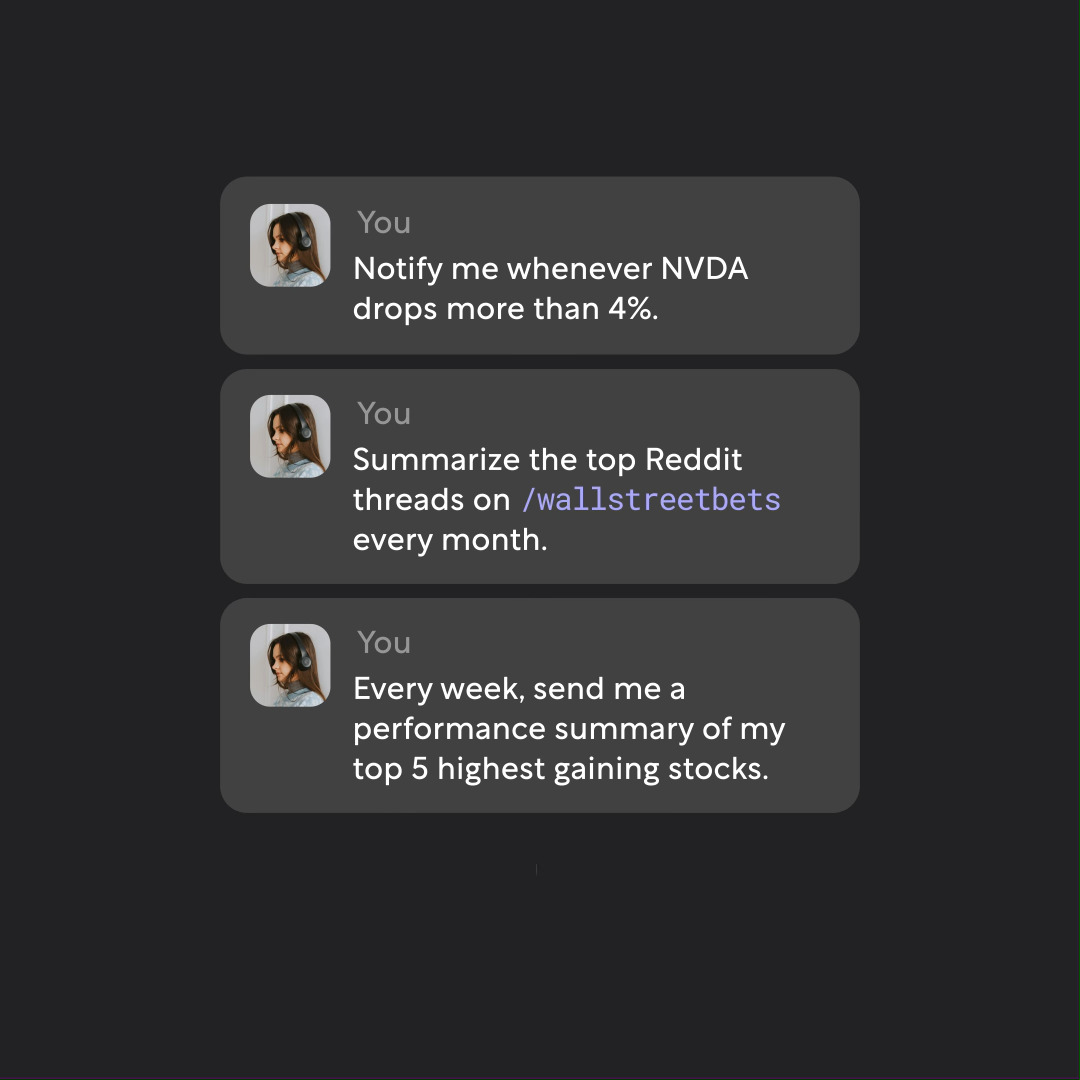

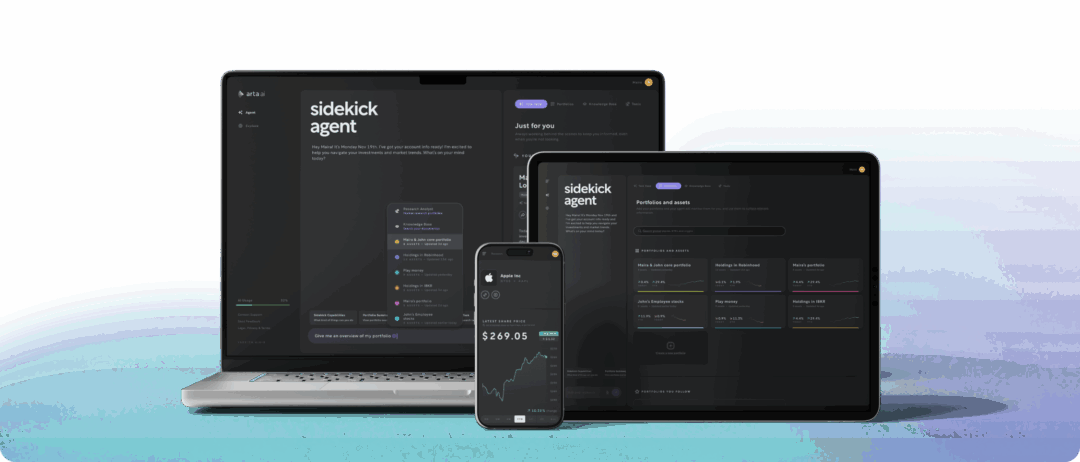

In order to uncover pertinent portfolio information and optimise daily operations, Arta AI Sidekick provides each adviser with a dedicated AI agent that links client portfolios, firm data, research, and product intelligence. It frees up advisors’ time to focus on direct relationships and higher-value advisory services while assisting them in making quicker, better-informed decisions and engaging every customer at scale.

“Financial institutions of every stage, from established private banks to digital-native wealth or investing platforms, are realising that AI can drive scale, engagement and rigour while maintaining the human connection that defines great client service,” said Caesar Sengupta, CEO of Arta. “Arta AI is purpose-built for wealth and investing. It augments advisor expertise, strengthens analytical rigour, and ensures transparency across all client interactions.”

AI That Works With A Private Banker

Arta AI uses a conversational interface that is easy to use to produce insights of institutional quality. Real-time market pricing, validated data, firm-specific CIO research, and generative AI are all combined to provide clients and advisors with the means to automate reporting and analytical activities and investigate novel approaches to improve client engagement. Advisors may interact in several languages, integrate proprietary research, conduct stress tests or Monte Carlo simulations, and analyse portfolios instantaneously.

With its smooth integration into the ecosystems of banks and brokerages, Arta AI facilitates white-label deployment and firm-specific training for proprietary research, compliance, and brand voice. Advisors may automate reports, combine holdings across asset classes, and improve proactive outreach, transforming each client interaction into a chance to strengthen and expand the relationship.

Leading Private Banking Institutions Use Arta AI

Arta AI is being used by Bank of Singapore, a wholly owned private banking subsidiary of OCBC, Southeast Asia’s second-largest financial services group, to improve its offering for EAMs [Enterprise Asset Management] and family offices.

The Bank of Singapore Global Head of Financial Intermediaries, Family Office, and Wealth Advisory (FFWA) Leong Guan (LG) Lim manages one of the bank’s fastest-growing areas. The FFWA desk provides institutional-grade investment products and technology to EAMs and family offices.

LG Lim said that while Singapore has long been a hotspot for ultra-high-net-worth families, many EAMs and family offices struggle to use global market-relevant technology. Bank of Singapore is enabling EAM clients personalise portfolio management, automate deep investment research, and offer ideas and market intelligence with Arta AI.

The Hong Leong Bank (HLB) engagement with Arta AI is part of its strategy to build its wealth business through value-added alliances. HLB will use Arta AI to assist its relationship managers to offer bespoke investment possibilities aligned with its product risk strategy and benchmarked against its CIO research and model portfolios.

Picture Source:Arta Finance