PBFIA releases first major report at Plant Based Summit in New Delhi

Plant Based Foods Industry Association’s [PBFIA] first major report, The Dawn of a Plant-Based Age was launched at the Plant Based Food Summit in New Delhi on May 26 [2022] by Mr Sanjay Sethi, Executive Director.

The report provides an overview of the global plant-based foods market and potential opportunities that will enable India to lead the way to global food security and nutrition.

We are pleased to provide the overview provided as Chapter 1 of the report here:

The plant-based foods sector is growing rapidly around the world across key metrics: consumer interest, product sales, and private and public investment. Most importantly for its near-term growth, the sector has entered the mainstream and attracted interest from consumers who do not define themselves as vegetarian or vegan.

Significantly increased investment in research and development for both product characteristics and manufacturing processes are also providing a strong foundation for the relatively young industry. Globally, the future of the plant-based foods sector is bright – the sector’s growth is certain, even as its path is still being charted.

Overview of the Global Plant-Based Foods Market

Sales

Comprehensive global data on the plant-based sector is still limited, but data from specific markets provides insight into the sector’s overall trajectory.

The retail market currently provides the strongest data, and estimated global sales of plant-based meat and plant-based milk products continued impressive growth in 2021. Retail plant-based milk sales grew 14 percent to $17.8 billion and plant-based meat sales grew 17 percent to $5.6 billion. Over a five year timeframe, retail plant-based milk sales grew 18 percent, affected by relatively flat sales from 2018 to 2020. In contrast, retail plant-based meat sales have seen consistent annual growth rates ranging from 14 to 33 percent over the same timeframe, achieving 100 percent growth in total.1

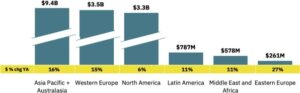

Asia Pacific led the plant-based milk sector in retail sales in 2021 with $9.4 billion and also saw the largest growth at 16 percent. Sales were comparable in Western Europe and North America, at $3.5 billion and $3.3 billion, respectively, with the growth rate in Western Europe more than doubling that in North America. Sales in the rest of the world were just over $1.6 billion, though every region saw significant growth.1

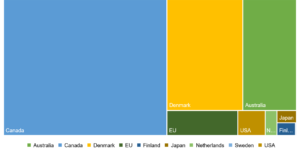

Global Plant-Based Milk Retail Dollar Sales and Dollar Sales Growth by Region

Credit: Good Food Institute

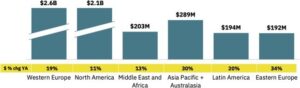

Meanwhile, Western Europe and North America led retail sales for plant-based meat, with $2.6 billion and $2.1 billion, respectively. While sales in Asia Pacific and Eastern Europe were $289 million and $192 million, respectively, both saw growth over 30 percent. Sales in the rest of the world totaled $395 million.1

Estimated Global Plant-Based Meat Retail Dollar Sales and Dollar Sales Growth by Region

Credit: Good Food Institute

Notably, when including tofu in the plant-based meat category, Asia Pacific again leads the pack at a value of over $16 billion in 2020. China is the largest market in the region, accounting for 70 percent of the total value.2

Private Sector Investment

As consumer interest and sales grow for the sector, there has been an accompanying surge in private and public sector investment. Such investment is driving the swift growth of new companies like Beyond Meat and Oatly, the adjustment of priorities for industry giants like Nestlé and Unilever, and an explosion of startup companies bringing new products to the market. Investment is focused on both increasing consumer access and product improvement – companies are improving recipes and rereleasing established products, such as the Beyond Burger 2.0 and 3.0, and both public and private sector funding is focused on improving manufacturing processes and product characteristics (e.g., taste, texture, nutrient content).

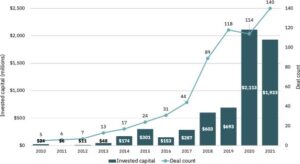

Capital investment in plant-based companies totaled $30 million in 2010 and 2011, but a decade later investment skyrocketed to $4 billion in 2020 and 2021 – a 13 thousand percent increase. Since 2010, over $6.3 billion has been invested in plant-based companies, with 63 percent of that investment occurring in just the last two years.1

Annual Global Investment in Plant-Based Companies

Credit: Good Food Institute

Capital investment in plant-based companies totaled $30 million in 2010 and 2011, but a decade later investment skyrocketed to $4 billion in 2020 and 2021 – a 13 thousand percent increase. Since 2010, over $6.3 billion has been invested in plant-based companies, with 63 percent of that investment occurring in just the last two years.1

Following the same trajectory, the number of investment deals increased from 5 in 2010 to 140 in 2021. The investor pool is growing as well – the number of unique investors grew by 40 percent in 2021, with 312 new investors of the total 1,093 investors in the sector since 1980. Two standout events from 2021 include Impossible Foods raising a $500 million funding round and Oatly’s IPO raising $1.43 billion.1

Regionally, North America led in both investment capital at $1.2 billion and deals at 63 in 2021 while investment topped $800 million in the rest of the world. Investment in Latin America was $310 million with only 7 deals, whereas Europe and Asia Pacific each had less total investmentacross a higher number of deals, at $248 million with 42 deals and $220 million with 25 deals, respectively. The Middle East only saw $35 million invested with 3 deals.1

Ingredients & Supply Network Capacity

Only a handful of ingredients currently make up the majority of the plant-based foods globally. For plant-based milk, soy has long been the dominant ingredient, though other plant-based milks are rapidly gaining a share of the growing market. In 2010, sales for soy-based milk more than tripled other plant-based milks, but in 2021 soy-based milks accounted for less than 40 percent of the total plant-based market. Almond, coconut, oat, and rice milks all now make up a sizable portion of the market, with oat-based milks seeing the fastest growth in recent years.3,4,5

Commodity crops account for the majority of the plant-based meat products and ingredients currently. Of the top 75 plant-based meat products in the United States in 2020, 62 percent are primarily wheat- and soy-based, 16 percent are primarily pea-based, and 14 percent are primarily soy-based. Chickpeas are an emerging protein, but still occupy a small subset of the market. The top eight most commonly-used ingredients include: soy protein concentrate, soy protein isolate, wheat gluten, pea protein, coconut oil, canola oil, sunflower oil, and cocoa butter.6

While commodity crops will continue to be appealing for manufacturers in the near-term, the landscape is changing as companies explore the use of a wider range of ingredients and crops are bred to have improved characteristics. Innovation in the plant-based egg sector has seen the use of lentils, mung bean, and chickpea by companies like Eat Just (US), Eggcitables (Canada), and PlantMade (India).7,8 Even seaweed, which has an advantageous mix of high protein content, low environmental footprint, and processing functionality – such as seaweed is attracting significant attention.1

Advancements in breeding could significantly improve crop utility for use in plant-based foods, such as by increasing protein content, improving solubility and water-binding capacity, and decreasing the level of metabolites and enzymes which can negatively impact taste.1

Government Investment and Policy Landscape

The rapid growth of the plant-based foods sector has put it higher on governments’ agenda.

Viewing the sector as both an economic growth and sustainability opportunity, governments are beginning to proactively invest and foster growth. Governments are investing hundreds of millions in the alternative protein sector, including announcements and grants which top $460 million to expand plant-based food R&D and processing capabilities. Canada is leading the charge, while Australia, Denmark, Finland, Japan, United States, have invested as well.9

Government Investment in Plant-Based Foods

In 2018, Canada announced an agreement to invest $153 million in the Protein Industries Canada Supercluster– a coalition of businesses, academia, and nonprofits – and will be matched dollar-for-dollar by the private sector.10 One example of such investment is an $8 million public-private investment project to develop new plant-based foods and ingredients utilizing some of Canada’s most widely grown crops.1 In Denmark, the Danish Ministry of Food, Agriculture and Fisheries launched Plantefonden, a $98 million investment fund to support development of new crops, cultivation methods, processing methods, product development, and public education.11 In Australia, the government is contributing $65 million to a public-private project to construct three plant protein manufacturing facilities to supply both domestic and international markets.12

Regulatory approval of novel ingredients and debates on labeling have been complicating factors for the sector’s growth, but thus far the impact has been minimal. While pressure from industry associations representing animal-derived proteins have argued that using nouns like “burger” and “sausage” or adjectives like “buttery” can confuse consumers, regulations to censor the terminology of plant-based foods have largely stalled. At the same time, approvals for novel ingredients – such as Eat Just’s mung bean-based eggs in Europe and Impossible Foods’ heme ingredient in Australia and New Zealand – are opening new markets for plant-based food companies and setting the stage for continued growth.1

The Future

Financial institutions are projecting strong continued growth for plant-based foods.

Analyzing the potential growth for alternative milk and meat (potentially inclusive of plant-based, cultivated, and/or fermentation-derived products), Credit Suisse projects global sales of alternative dairy and meat to reach between $146 billion and $380 billion by 2030. By 2050, the bank projects sales between $748 billion and $1.4 trillion.13

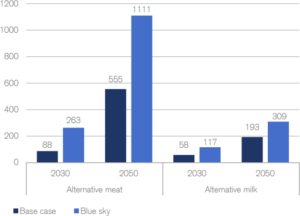

Potential Size of Alternative Meat and Milk Market Globally (USD billion)

Credit: Credit Suisse

In these projections, although alternative milk is assumed to achieve a higher percentage of its respective market, alternative meat sales would lead overall due to the size of the market. For instance, in the high-growth scenario for 2050, alternative milk would account for $309 billion in sales compared to $1.1 trillion for alternative meat.13

Market growth is driving innovation for plant-based foods at every step of production. 2021 saw an expansion in the number and utility of plant-based ingredients, advancements in the efficiency and scalability of processing techniques, developments in the use of novel technologies (e.g., 3D printing, high-moisture extrusion technology), and improvements to the nutritional and sensory components of products.1 On the production side, such innovation will bring a range of new, improved products to market at increasingly competitive prices compared to animal-derived products.

For consumers, the strong nutritional profile of plant-based foods will be essential to widespread uptake and particularly so for children. Examples of such products exist in the market already – Ripple fortifies its plant-based milk for kids, which has DHA, choline, prebiotic fiber, calcium, magnesium, riboflavin, and vitamins A, D, and B12; Danone launched Wondermilk which has the fat, vitamin, and mineral content of cow’s milk; and Unilever has developed a fortified soy product for the South African market that is more nutritious than the animal-derived mincemeat it replaces.1,2 Additionally, Danone’s Silk brand and Danish brand Naturli’ have products which aim to replicate the sensory components of cow’s milk, which could catalyze the transition of consumers who currently prioritize a familiar taste, texture, and aroma.1

The Good Food Institute projects 2030 production requirements will outpace the industry’s supply network capabilities without an increased rate of investment, particularly for pea and soy proteins. There has been recent evidence of this in the market already. Focusing on pea protein, which has seen significant growth in the last decade, the sector will likely require 10x the current projected global supply of enriched forms of pea protein by 2030 – accounting for 34 percent of pea production overall.6 At the same time, there is increasing interest and opportunity for utilizing a wider range of plant proteins, such as fava beans; for instance, Nutris Group invested $32 million in a hybrid processing facility for fava beans and potatoes and Beneo invested $53 million in a processing facility for fava beans.14 The future demand for plant-based food ingredients is difficult to predict and will almost certainly change as research improves manufacturing processes and the nutrition, functionality, and yields of crops themselves. In all likelihood, as with the plant-based sector as a whole, the future market will be driven by the research and investment of the next decade as the sector grows into its potential.