First HK-Guangdong Joint Laboratory in Banking launched

Hong Kong University of Science and Technology (HKUST) and WeBank Co. Ltd (WeBank) announced ( on May 20, 2019) they are establishing the HKUST-WeBank Joint Laboratory to explore cutting-edge technologies and nurture talent. This also serves as a high-level collaborative innovation platform for enterprises, universities and research institutes and to promote knowledge transfer under the GBA Development Framework.

WeBank,initiated by Tencent and officially launched on December 16, 2014,is China’s first private and digital-only bank.It is also WeBank’s first research collaboration with a local university in Hong Kong, and the first joint banking lab project between Guangdong and Hong Kong.

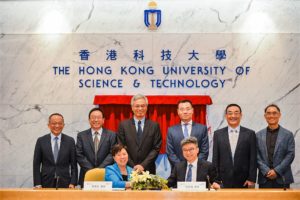

According to the agreement, a scientific committee will be set up to identify the most relevant projects for both parties and will cover areas such as machine learning, blockchain, AI operations and data mining for in-depth research ventures. The agreement was signed by Prof. Nancy IP, Vice-President for Research and Development of HKUST, and Mr. Henry MA, Executive Vice-President and Chief Information Officer of WeBank.

WeBank Chairman and CEO David Ku commented “the lab shall be rooted in the GBA and grasp its development opportunity as well as embrace the world. The lab visions an inclusive collaboration with all types of potential partners in driving Fintech underlying algorithms and technological research. We hope to see more use cases and innovative business models that tackle the existing pain points of SMEs and retail customers.”

HKUST President Prof. Wei Shyy, part of the officiating ceremony added,”I hope with HKUST’s research capability and WeBank’s experience in applying innovative technologies in mainland’s banking industry, we will be able to develop new banking technologies for transfer into products with social impact as our cooperation deepens.”

Some possible research topics of the joint lab include: how to protect data privacy amid sharing of resources and how to establish a blockchain consortium or apply new technologies such as the collaborative business model. The lab will seek to increase banks’ risk management capability by monitoring bank transactions and assisting officers in risk analysis and system maintenance work through machine learning and data mining. It will also seek to enhance the banking industry’s development through Fintech and other cutting-edge technologies. Nine research proposals have been summited to the joint lab so far in the fields of blockchain, risk management and AI.

Source: WeBank